Bookkeeping Set-Up

Implementation Cost:

$800.00 (Includes 1st Month of Software Subscription)

Monthly Software Subscription Fee:

$25.00 - $235.00

Monthly Service Fee:

$0.00

Service Term:

No Service Term

At 614 Associates, we understand that getting your financial systems in order is one of the most critical steps for a successful business. Whether you're launching a new venture or need to bring structure to an existing business without a reliable bookkeeping system, our Bookkeeping Set-Up service is designed to provide a smooth, smart, and scalable foundation for your financial operations.

What We Do

1. Discovery & Business Analysis

We begin with a deep-dive consultation to understand your business model, industry, operational workflow, revenue streams, and financial goals. This step ensures that we fully grasp how your business operates day-to-day so we can tailor your bookkeeping system accordingly.

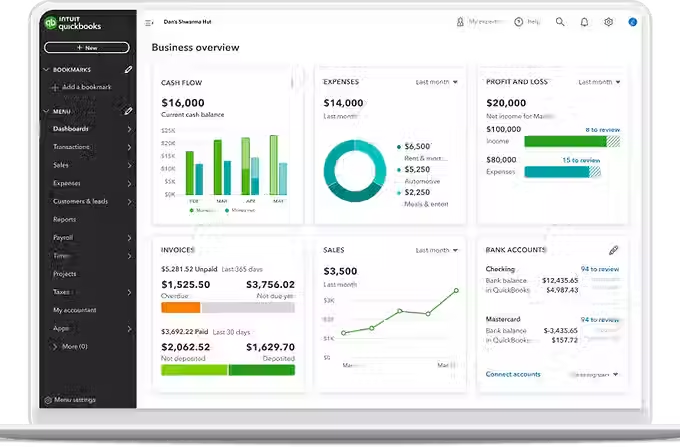

2. Product Recommendation & Setup

Based on your needs, we’ll recommend the most appropriate Intuit QuickBooks Online product—whether it's Simple Start, Essentials, Plus, or Advanced. We’ll walk you through the features and ensure the selection aligns with both your current needs and long-term growth.

3. Custom Configuration

We don’t believe in cookie-cutter setups. Once the right QuickBooks Online plan is chosen, we’ll fully customize the platform to reflect your business’s structure. This includes:

Creating a customized chart of accounts

Setting up bank feeds and payment processing integrations

Establishing income and expense categories

Configuring customer and vendor profiles

Applying sales tax and payroll settings (as applicable)

4. Workflow Design & Best Practices

We’ll build out workflows that support smooth bookkeeping processes—like how to handle invoices, receipts, payments, and reconciliation—based on industry best practices and your preferred method of record-keeping.

5. Walkthrough & Orientation

Before we turn the system over to you, we’ll provide a guided walkthrough so you’re comfortable navigating QuickBooks Online. We’ll explain where to find reports, how to track transactions, and how to keep your records updated moving forward.

6. Support & Next Steps

After setup, we’ll provide you with a custom checklist and workflow guide to maintain your system confidently. If desired, you can explore our ongoing bookkeeping and payroll services for continued support.

Let’s Build a Strong Financial Foundation Together.

Our Bookkeeping Set-Up service is more than just software installation—it’s a strategic, customized onboarding experience that empowers you to manage your finances with accuracy, efficiency, and confidence.

Who Is This Service Tailored For?

This service is ideal for businesses that have the time and confidence to manage their own bookkeeping once a system is properly set up. We’ll implement your QuickBooks Online system based on best accounting practices and tailor it to fit your specific operations—so you can take it from there with clarity and control.

What Is NOT Included?

While our Bookkeeping Set-Up service gives you a fully customized QuickBooks Online foundation, it does not include the following:

Ongoing Bookkeeping Services

(e.g., monthly transaction categorization, reconciliations, financial reporting)Payroll Processing

(Setting up and managing employee payroll systems or running payroll cycles)Sales Tax Filing or Remittance

Year-End Financial Preparation or Tax Filing

CPA or Tax Advisory Services

Catch-Up Bookkeeping

(Importing, cleaning, or reconciling large volumes of past transactions)Third-Party App Integrations Beyond QuickBooks

(e.g., inventory, POS, or CRM systems)Invoicing and Bill Pay Management

Hands-On QuickBooks Training

(We do provide a basic walkthrough, but not full training sessions)

If you need any of the above, we’d be happy to discuss additional service packages or custom solutions that fit your needs!

Important Disclaimers

This is a One-Time Setup Service

This service includes the initial configuration of your QuickBooks Online system. It does not include ongoing bookkeeping, data entry, or system maintenance after the setup is complete.Client Participation is Required

Successful setup depends on your timely cooperation, including the provision of business information, access to financial accounts, and relevant documentation.Software Subscription Not Included

The cost of this service does not include your QuickBooks Online subscription. Clients are responsible for maintaining an active subscription, which may be purchased through us or directly from Intuit.Data Accuracy is a Shared Responsibility

We rely on the accuracy and completeness of the information you provide. 614 Associates is not responsible for errors resulting from inaccurate or incomplete data submitted by the client.No Tax or Legal Advice Provided

This service does not include tax planning, tax preparation, or legal consulting. We recommend working with a licensed CPA or attorney for those needs.Historical Data Clean-Up Not Included

Any backdated transaction entry or data clean-up from prior periods must be quoted separately and is not part of the standard setup service.Basic Training Only

A brief walkthrough of your new system is provided upon completion. This is not a substitute for full training in bookkeeping or QuickBooks software.Limited Scope for App Integrations

Integration with third-party platforms (such as inventory management, point of sale systems, or CRM tools) is outside the scope of this package and may incur additional fees.Privacy & Security Commitment

All client data is handled with strict confidentiality in accordance with our Privacy Policy and Data Handling Protocols.Service Must Be Used Within a Set Timeframe

Once purchased, the Bookkeeping Set-Up service must be scheduled and completed within 90 days, unless otherwise agreed in writing.

Our Ethical Commitment

At 614 Associates, we hold ourselves to the highest standards of integrity, accuracy, and transparency in all the services we provide. As bookkeeping professionals, we are obligated—and proud—to operate in full compliance with all applicable financial reporting standards, tax regulations, and ethical guidelines.

We are committed to the following principles:

Accuracy and Honesty: We report all financial transactions as they are presented and do not manipulate data to misrepresent the financial condition of any business.

Compliance over Evasion: We do not and will not engage in, support, or advise on any form of tax evasion or illegal avoidance strategies. Our role is to ensure accurate financial records—not to reduce tax liability through unethical or unlawful means.

Client Accountability: While we provide tools and services to support accurate recordkeeping, the ultimate responsibility for the accuracy and legality of all financial records and tax filings remains with the client.

Confidentiality and Trust: We treat all client information with the utmost confidentiality and professionalism, adhering strictly to privacy and data security policies.

By working with 614 Associates, you are partnering with a team that values lawful compliance, responsible reporting, and ethical service delivery above all else.

Interested In Our Services?

Interested in getting started? Want to learn more? Fill out the form below and we will be in touch as soon as possible with the next steps!